New York lawmaker proposes bill that would prevent student loan forgiveness from state tax

NEW YORK CITY -- A new bill in Albany aims to stop the state government from taxing student loan relief.

New york tax authorities have promised to leave potential federal forgiveness alone.

But the bill's sponsor, Queens Democrat and Senate Deputy Majority Leader, Michael Gianaris says this bill would give people peace of mind that the money can't be taxed.

According to senate majority leader Chuck Schumer, about 2.5 million New Yorkers could benefit from student loan forgiveness.

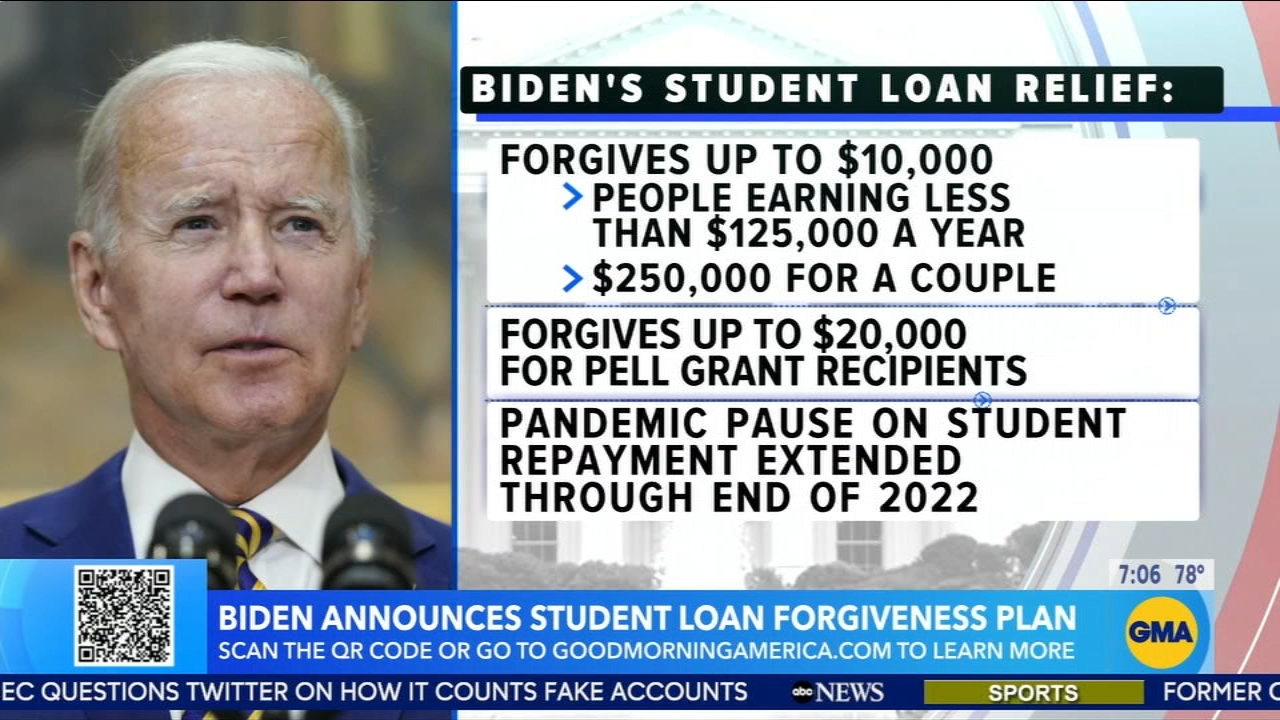

President Biden announced the historic student loan forgiveness plan last month with some borrowers getting up to $20,000 in debt forgiven.

RELATED | What's a Pell grant? How it affects student loan forgiveness for millions of people

Other measures included in the plan would regulate student loan interest rates and allow borrowers who made payments through the pandemic to receive a refund.

Up to 43 million Americans will receive relief from Biden's student debt plan, and about 20 million will have their debt fully eliminated.

Current students whose loans are dispersed on or before June 30, 2022, are also eligible for forgiveness.

Parent Plus Loans and Graduate Loans are included in the loans that can be forgiven.

Anyone interested in learning more about their elegiblity for forgiveness should check the Federal Student Aid website.

The deadline to apply for forgiveness is December 31, 2022.

Biden also announced the final pause on student loan interest will be extended through the end of 2022.

ALSO READ | 7 On Your Side's money moves to make and avoid for student loan forgiveness plan

----------

* Get Eyewitness News Delivered

* Download the abc7NY app for breaking news alerts Submit a News Tip