7 On Your Side's money moves to make and avoid for student loan forgiveness plan

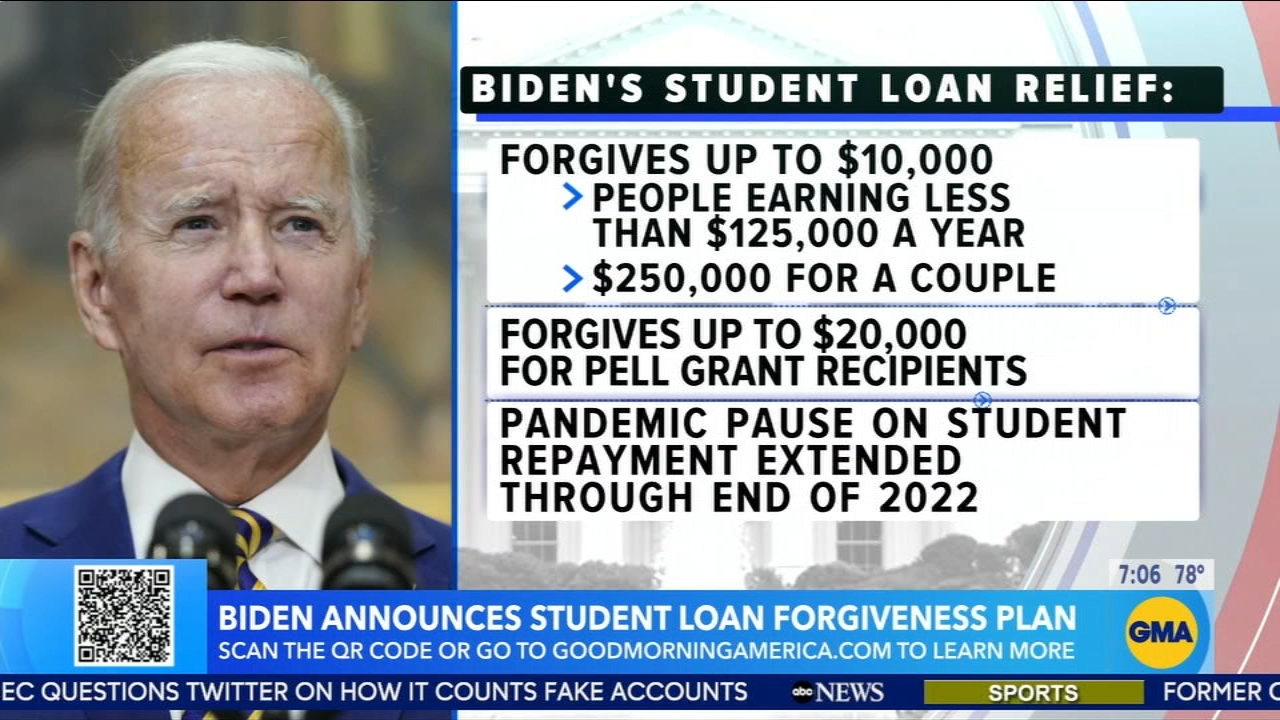

NEW YORK (WABC) -- President Biden's big announcement on debt cancellation for millions struggling with student loans means the amount people owe could fall by as much as $20,000 -- a huge relief for families.

7 On Your Side has what borrowers need to do next and what not to do to take full advantage of the debt forgiveness.

The heat has been turned down on paying back the multiple loans that Mike Petruk took out to pay for his degree from Stockton University.

"I'm trying to struggle to pay off this loan that I have," Petruk said.

Federal and private loans have been haunting him and his mom, Cindy, since graduation in 2020.

"He has 25K with federal waiting for whatever may happen with those," Cindy said.

Because he makes less that $125,000 at his job managing Bistro Bar in Red Bank, he's eligible for up to $10,000 in federal loan forgiveness. If he had taken out a Pell grant, he could have up to $20,000 canceled.

"There's no doubt people were drowning in student loan debt, this new announcement is like a lifesaver," said debt relief attorney Leslie Tayne.

Tayne suggests certain money moves to make sure you get what's coming.

1.) Reach out to your loan servicer

Make certain your records are updated and verify that your address, email and phone number are all accurate. Make sure to get it in writing.

"So many people have moved around in the last several years, and it's not uncommon for borrowers to avoid their debt," Tayne said. "You don't want to miss other important announcements or notifications."

2.) Monitor reliable websites

Consult studentaid.gov, the U.S. Department of Education's site. Most borrowers will have to fill out an application -- don't just assume you are registered.

Be wary of fraud. The federal government will not call and threaten to withhold funds and they will never ask you to verify personal information.

"If you receive a solicitation by phone and they ask you for information like your social security number, login information, for credit card information, bank account information, that is a red flag," Tayne said.

3.) Prepare

Prepare a budget and get ready to show income information. If you have not filed your taxes in the last two years, you'll need to do so to provide proof of earnings. And lastly don't overspend, prepare for possible repayment.

"Don't assume you're getting the full amount until you get the notice that until you get the notice with the exact dollar amount, it's kind of like counting your chickens before they hatch," Tayne said.

And lastly don't miss the boat to be notified when the loan cancellation process has officially opened up, sign up on the DOE's subscription page.

RELATED | What's a Pell grant? How it affects student loan forgiveness for millions of people

----------

SHARE YOUR STORY

Do you have an issue with a company that you haven't been able to resolve? If so, 7 On Your Side wants to help you!

Fill out the form below or email your questions, issues, or story ideas by filling out the form below or by emailing 7OnYourSideNina@abc.com. All emails MUST INCLUDE YOUR NAME AND CELLPHONE NUMBER. Without a phone number, 7 On Your Side will not be able to respond.