Coronavirus News: Individuals behind on child support, spouses denied stimulus checks

NEW YORK (WABC) -- Millions of people who owe child support and their current spouses may not receive stimulus checks authorized under the federal CARES Act intended to help people survive financially during the COVID-19 pandemic.

While the federal government has suspended certain debt payments, it didn't suspend unpaid child support.

"You've still got to pay back the arrears. I understand that," said Nicodemus Vazquez. "But not in the middle of an emergency pandemic."

Vazquez said he owes his ex-child support for their child who is now fully grown. He is currently remarried and has a young child with his current wife.

Vazquez said he had been working to pay back the child support he owed each month when the pandemic left him unemployed.

Because the stimulus checks are calculated by household, many spouses to individuals who owe child support have complained their share of stimulus relief is being garnished by the federal government as well, even though they have done nothing wrong.

"It's like the federal government just left us," Vazquez said. "I mean how do you do that? It seems like a racial thing to me to be honest. It's more the low income and black folks in this predicament."

Census Data indicates more than 5.8 million individuals owed child support in 2015, but less than half of those individuals paid everything they owed.

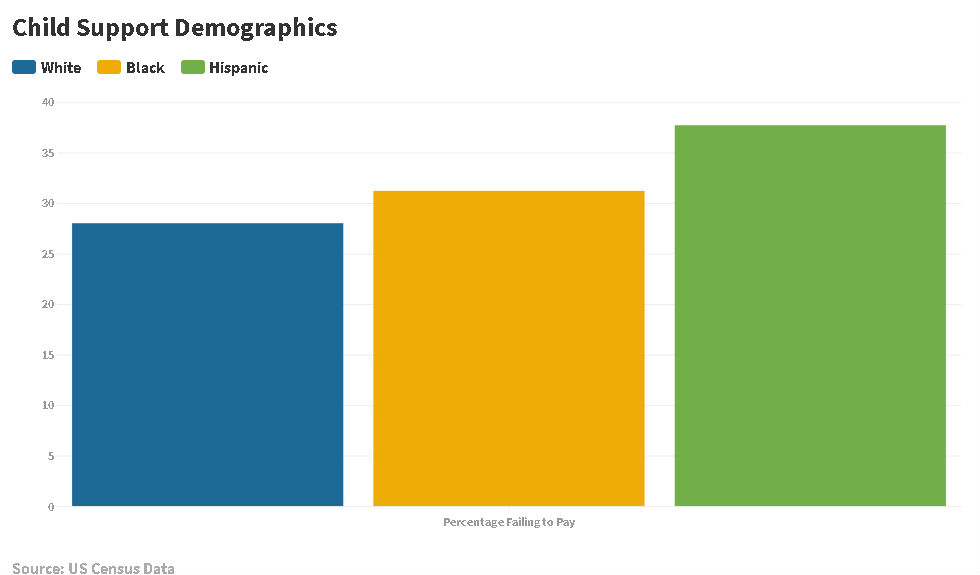

Eyewitness News found black and Hispanic parents were also more likely to fall behind on child support than white parents.

"The very people who need the most are the ones who end up being harmed by this," said University of New Haven Professor Lorenzo Boyd, an expert in racial and income inequities. "A lot of these systems that we have bring to bear their weight on the people who can least afford to fight back."

Boyd said the policy of withholding the stimulus checks promised under pandemic relief would likely further reinforce financial difficulties that often contribute to individuals falling behind on child support.

"I get that the children also need the money," Boyd said. "And so it seems to me that a fair way to address this would not be to take the whole stimulus check but to prorate it or take a portion of it."

The treasury department has offered a partial solution.

Spouses to an individual who owes child support can file an "injured spouse form" with the IRS to obtain a portion of the stimulus assistance they would have received as an individual.

MORE CORONAVIRUS COVID-19 COVERAGE

COVID-19 Help, Information and Resources

UPDATES

Grieving the lost: Tri-State residents who have died

RELATED INFORMATION

Share your coronavirus story with Eyewitness News

Stimulus check scams and other coronavirus hoaxes

Coronavirus prevention: how clean are your hands?

Centers for Disease Control and Prevention on coronavirus

Total count of NYC COVID-19 cases based on patient address